A different point of view on investing, markets, and life.

By asking the right questions, we uncover better answers.

Together, we'll reconnect you to what matters most and create a tailored wealth plan that empowers you to take control of your financial affairs, giving you the confidence that you’re on the right path.

A Quantitative's Guide to Investing in the Stock Market - Slava Platkov [Masters in Investing EP03]

.webp)

How to Choose World Class Companies - Chris Wheldon [Masters in Investing EP02]

.webp)

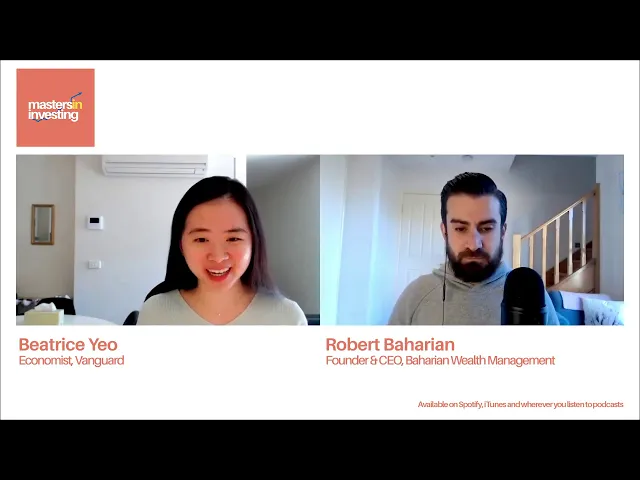

Hypothesising a Post COVID World - Beatrice Yeo [Masters in Investing EP01]

How concerned should I be about the US election and my share portfolio? - Fast Money Episode 05

.webp)

This one chart...US unemployment rate & party

Fed Official Warns of 30% Unemployment - US News We have not seen such levels of unemployment in the last 70 year. Although the unemployment rate did reach almost 14% during the height of the COVID crisis. Since reaching it's new 70 year peak, the US unemployment rate has retraced back to 7.9%.

Fast Money Episode 04 - When should I start saving for my retirement?

Ready to grow your wealth?

Let's talk. One call. No risk. Just a way to see if we're a good fit.